Beginning a loan organization is simpler than you may think. There are, nevertheless, a couple of decisions to be made. The following steps discuss the biggest ones. Now let's stroll through each action. There are lots of legal distinctions in between a consumer loan company and commercial (B2B) lending institution. Consumer loan services are highly controlled by a host of federal firms watching to make certain consumers are not taken benefit of.

For example, usury (the optimum amount of interest that can be legally charged) differs dramatically from state to state and depends upon the type of consumer loan. This post will concentrate on beginning a loan service that provides money to other organizations. Business loan companies that provide money to organizations do not deal with many regulatory problems.

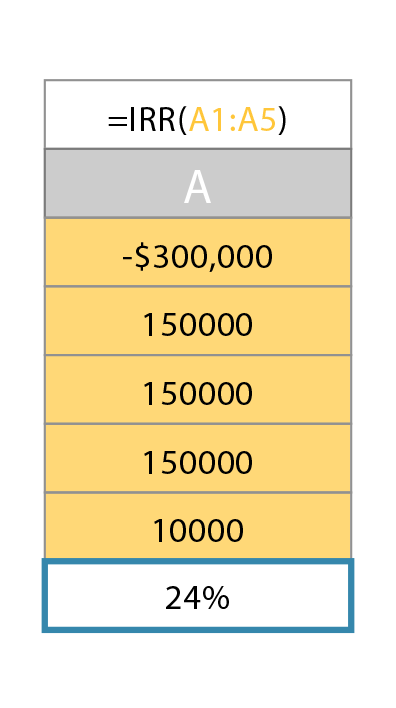

The second thing I tell anybody who asks me how to begin a loan organization is to decide what type of return you're trying to find. Lender that make company loans can take pleasure in a substantial return on investment (ROI). The huge consider identifying your roi is whether you are going to loan long-lasting cash or short-term money.

Whether you utilize your personal funds, financier funds, or use a wholesale lender, your monetary yield can be quite great by lending short-term money to services. Market associations like the International Factoring Association (IFA) have numerous resources that can assist you get started if you choose to begin an invoice factoring company.

The returns on short-term business loans can be quite good. Image: VisualHunt. com Merchant cash loan loan providers are business lender that lend money to numerous types of organizations and are repaid through an everyday, weekly or monthly automated withdrawal from the debtor's company banking account. Most merchant cash loan companies limit their loans to 12 or 15 months, while invoice factoring business earn money as quickly as your client pays.

Rumored Buzz on What Is The Meaning Of Finance

Risk tolerance and industry competence enables company lender to either be generalists that spread their threat throughout numerous types of companies, or niche lending institutions that concentrate on a particular market. The most typical markets where niche loan providers are discovered are in: Financing staffing companies Transport companies Oil field service companies Staffing and transport are likewise 2 of the most competitive markets to work in.

On the other end of the spectrum are construction services. There is far more threat in building and construction business financing, so there are less competitors, however the companies that finance construction business can understand a much greater return on investment. Another highly specialized niche is medical third-party insurance coverage funding. Business that lend cash versus insurance coverage receivables need to be great at their price quotes of repayment.

Among merchant cash advance lending institutions, specific niches can include: Restaurants Benefit shops Hospitality-related business Lenders who loan in these niches typically examine three to four months of credit card invoices and base their loan as a portion of the average daily charge card deposit. There are a few franchise lenders in the U.S.

In addition to supplying training and assistance with underwriting loans, they often serve as a wholesale lender to a specific franchisee. The largest franchise lending institution in the U.S (how to start a finance company). is Liquid Capital. Liquid Capital helps their franchisees make billing factoring loans, purchase order loans and merchant cash loan https://www.ktvn.com/story/43143561/wesley-financial-group-responds-to-legitimacy-accusations loans. Because Liquid Capital (and similar business) supply so much support, you share your revenues with them and your roi is lower.

When beginning a loan company, the expression, "it takes cash to earn money" is necessary. Be prepared to inject some equity into the company, either individual money or cash from financiers. With the type of high profits industrial loan business make, organic development can occur quickly. Image: VisualHunt. com The great news is, you can start small and grow.

How To Get Finance With Bad Credit for Beginners

These are usually big banks or larger lenders that are ready to loan you cash at a reduced rate so you can re-loan the cash out at a much greater return. The more experience you have and the more secure a wholesale lender believes your portfolio is, the less your wholesale loan provider will charge you.

It's essential to have a quickly, secure, and customer-friendly (i. e. mobile-friendly) website. Reputable companies like GoDaddy supply all you need, from websites to data security. GoDaddy is a one-shop stop for numerous things you will need: To vegas timeshare have a website, you'll require a domain name and GoDaddy can offer that for you rapidly, quickly and cheaply.

You can build your own site using GoDaddy's GoCentral site contractor ( fast, trustworthy hosting is included) or let their experts construct one for you. GoDaddy also supports WordPress, another popular website contractor. Third, you require an SSL certificate to encrypt transmissions between your site and your prospect/customer. Savvy clients won't submit individual info to any site that does not display the https in their internet browser bar.

Look here for details on including an SSL to a WordPress website. Because you'll likely be accepting and storing very personal information handling financial resources, you might discover yourself a target of hackers. Prevent the cost and shame of an information theft with a robust site security product. GoDaddy Website Security, powered by Sucuri consists of a web application firewall software (WAF) for a strong defense versus malware and other security risks.

There are numerous software application systems available to do this. A business loan company not only fuels the economy, it can support you. Photo: Visualhunt This post might not have answered all of your questions around how to start a loan company however I hope it's offered you a solid understanding of the essential actions.

The Facts About Which Of These Methods Has The Highest Finance Charge Revealed

A properly designed organization website will keep a stream of good prospects calling you, filling out ask for information and using your website as a portal to manage their impressive loans. Image by: Visual Hunt.

Constructing a brand-new monetary services company, or any company, is challenging. The prospective advantage is worthwhile - particularly within monetary services - but the obstructions make success difficult to attain. When we started ReadyForZero, we were fairly new to financial services and knew there would be many hurdles prior to we might see our vision through to completion.

As my co-founder puts it "if you knew all the challenges ahead of time, you would reconsider prior to even beginning." We've had our share of frustrations along the method, some of which we wanted to share here: Wherever there are earnings, there are guideline and federal government oversight. Financial services business deal with a stringent and complicated regulatory landscape that is constantly changing.

We also discovered that the very best way to browse the regulative landscape is with the assistance of expert legal counsel. There is no rejecting that guidelines require to exist in order to protect customers. But many of them are obsoleted or do not support the most recent technologies (frequently the very ones you are wanting to advance).

And because these statutes are state-specific you will require the capital, persistence and support of a skilled legal team to file the necessary documentation and keep your compliance existing in every state your consumers live. Similarly, lending laws vary by state in the United States, in addition to being dependant on the quantity lent.